NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, NEW ZEALAND, HONG KONG, JAPAN, SWITZERLAND, SINGAPORE, SOUTH AFRICA, OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, PUBLICATION OR DISTRIBUTION OF THIS PRESS RELEASE WOULD BE UNLAWFUL, BE SUBJECT TO LEGAL RESTRICTIONS OR WOULD REQUIRE REGISTRATION OR OTHER MEASURES.

The Board of Directors of Nitro Games Oyj (“Nitro Games” or the “Company”) has today decided to arrange a partially secured rights issue of a maximum of 19,354,653 shares (the “Rights issue”), under the condition that the Extraordinary General Meeting to be held on 5 July 2023 gives authorization to the Board to resolve on the Rights issue. The subscription price is SEK 4.00 per share or EUR 0.34 per share, which means that the Company, upon full subscription in the Rights issue, can receive proceeds of approximately SEK 77.4 million before issue costs.

For each (1) existing share in the Company, one (1) subscription right is obtained. Two (2) subscription rights entitle the holder to subscribe for three (3) shares. The subscription period commences on 12 July and ends on 26 July 2023 in Sweden and 28 July 2023 in Finland. The Company has also secured a bridge loan of SEK 23.0 million (the “Bridge loan”) to be repaid in full, in cash, with proceeds from the Rights issue or offset against new shares in the Rights issue. The net proceeds from the Bridge loan and the Rights issue will primarily be used for marketing and user acquisition during the launch phase of the Company’s game title Autogun Heroes, as well as for finalizing the acquisition of the title. The Rights issue is secured to approximately SEK 46.5 million, corresponding to 60.0 percent of the Rights issue, through subscription and underwriting commitments.

The transaction in brief

• Upon full subscription in the Rights issue, Nitro Games will obtain gross proceeds of approximately SEK 77.4 million before issue costs.

• The subscription price in the Rights issue is SEK 4.00 per share or EUR 0.34 per share.

• For each (1) existing share held on the record date, one (1) subscription right is obtained in the Rights issue. Two (2) subscription rights entitle the holder to subscribe for three (3) new shares.

• The subscription period in the Rights issue commences on 12 July, and ends on 26 July 2023 in Sweden and 28 July 2023 in Finland.

• The Rights issue is secured to 60.0 per cent through subscription commitments of approximately SEK 17.5 million and underwriting commitments of approximately SEK 29.0 million.

• The Company has secured a Bridge loan of SEK 23.0 million from external investors who have also entered into subscription commitments and/or underwriting commitments in connection with the Rights issue. The Bridge loan carries a fixed interest rate of ten (10) per cent on the nominal loan amount for the period between the loan disbursement date and the repayment date, and shall be repaid in full in connection with the registration of the new shares issued in the Rights issue.

• The net proceeds from the Bridge loan and the Rights issue will be used for marketing and user acquisition during the launch phase and scale-up of the Autogun Heroes title, and for finalising the acquisition of the title. Additional net proceeds will be used to fund operational costs and generate financial flexibility for additional potential title acquisitions and development projects.

Background and motive in brief

Nitro Games is a Finnish free-to-play game developer and publisher engaging in the development and publishing of mobile games with high production value for mid-core audiences. With a focus on quality and commercial viability, the Company aspires to become a household name for action and shooter games.

The Company operates a well-diversified portfolio which currently consists of two games, NERF: Superblast and Autogun Heroes. The Company also operates a B2B service business through its current development service agreements with Digital Extremes and Supermassive Games.

The Autogun Heroes title, which was acquired from Danish game developer Doomsday ApS in September 2022 and soft launched in January 2023, is the most promising title in the Company’s portfolio. Soft launch data indicates superior KPIs compared to the Company’s previous games and selected competitor titles. Impressive user retention rates paired with strong conversion to paying customers pave the way for a highly promising and profitable scale-up during the launch phase, which commenced at the beginning of June 2023.

To capitalize on the opportunities associated with Autogun Heroes, the Board of Directors has now proposed a Rights issue of approximately SEK 77.4 million. In order not to lose momentum and to enable sufficient marketing and user acquisition during the ongoing launch phase, the Company has secured a Bridge loan of SEK 23.0 million. The proceeds from the Bridge loan are intended to be used for the following purpose:

• Marketing and user acquisition during the launch phase and scale-up of the Autogun Heroes title (SEK 23 million).

The net proceeds from the Rights issue are intended to be used for the following purposes, by order of priority:

• Repayment of the Bridge loan, including principal and interest (SEK 25 million).

• Marketing and user acquisition during the launch phase and scale-up of the Autogun Heroes title (SEK 6 million).

• Finalisation of the acquisition of the Autogun Heroes title (SEK 20 million). Additional net proceeds will be used to fund operational costs and generate financial flexibility for additional potential title acquisitions and development projects.

The Company’s largest shareholder, Nordisk Games A/S (“Nordisk Games”), has invested approximately SEK 65 million in the Company since 2020 and holds approximately 50.3 percent of the shares. Nordisk Games has decided not to participate in the Rights issue, but the company has indicated its support for the impending transaction and has entered into a 12-month lock-up agreement in connection with the Rights issue.

Terms of the Rights issue

The main terms of the Rights issue are presented below:

• Anyone who is registered as a shareholder in Nitro Games on the record date, 7 July 2023, will receive one (1) subscription right for each (1) existing share. Two (2) subscription rights entitle the holder to subscribe for three (3) new shares.

• The last day of trading in the Company’s share including the right to participate in the Rights issue is 5 July 2023, and the first day of trading in the Company’s share excluding the right to participate in the Rights issue is 6 July 2023.

• The subscription rights will be trading on Nasdaq First North Growth Market Stockholm (“First North”) from 12 July to 21 July 2023.

• The subscription price is SEK 4.00 per share or EUR 0.34 per share.

• The subscription period commences on 12 July, and ends on 26 July 2023 in Sweden and 28 July 2023 in Finland.

• The Rights issue entails an issue of a maximum of 19,354,653 shares, implying gross proceeds of approximately SEK 77.4 million upon full subscription in the Rights issue.

• For existing shareholders who do not participate in the Rights issue the dilution will be 60.0 per cent in the case of full subscription in the Rights issue.

Terms of the Bridge loan

The Company has secured a Bridge loan of approximately SEK 23.0 million to be repaid in connection with the Rights issue. The Bridge loan has been secured from external investors who have also entered into subscription commitments and/or underwriting commitments in connection with the Rights issue, and the terms of the Rights issue have been established through negotiations with said investors and are deemed by the Board of Directors to be at market.

The main conditions for the Bridge loan are stated below:

• The total nominal loan amount is approximately SEK 23.0 million.

• The interest rate for the Bridge loan shall be fixed at ten (10) percent for the period between the loan disbursement date and the repayment date.

• The Bridge loan, including the principal and interest, shall be repaid in full in connection with the registration of the new shares issued in the Rights issue, in cash or offset against shares in the Rights issue.

Subscription and underwriting commitments

Prior to the publication of the Rights issue, the Company’s Chairman of the Board Johan Biehl, Board member and CSO Antti Villanen, Board member Susana Meza Graham (through company), CEO Jussi Tähtinen, CFO Matti Nikkola (personally and through company), COO Jussi Immonen, and CTO Samppa Rönkä have entered into subscription commitments amounting to a total of approximately SEK 2.6 million, or 3.3 percent, of the Rights issue. In addition, external sector investors have entered into subscription commitments amounting to a total of approximately SEK 14.9 million, or 19.3 percent, by overtaking subscription rights from Nordisk Games. Furthermore, the Company has received underwriting commitments amounting to a total of approximately SEK 29.0 million, or 37.4 percent, of the Rights issue.

The subscription commitments do not entitle to any compensation. The underwriting commitments entitle to an underwriting fee amounting to ten (10) percent in cash, or alternatively, fourteen (14) percent in the form of new shares in the Company. The subscription price for the shares referred to in the underwriting compensation will be based on the volume-weighted average price for the Company’s share on First North during the subscription period in Sweden, but not less than SEK 4.00. This means that an additional maximum of 1,013,502 shares may be issued in the form of a directed issue to underwriters.

Overall, the Rights issue is secured by subscription and underwriting commitments amounting to a total of approximately SEK 46.5 million, corresponding to 60.0 percent of the Rights issue. Neither the subscription commitments nor the underwriting commitments are secured by bank guarantees, escrow funds, pledges or similar arrangements.

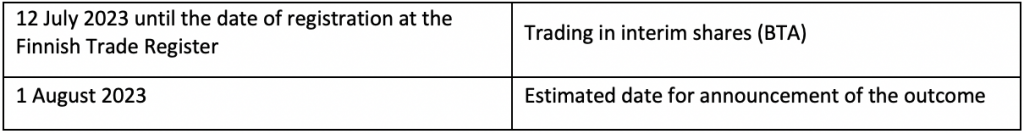

Indicative timetable for the Rights issue

Information to Finnish shareholders

Shareholders who have their shares in a book-entry account in Finland have their shares entered into the shareholder register maintained by Euroclear Finland Oy. To be able to trade on the subscription rights and interim shares (BTA) received in the Rights issue on First North, such investors will need to transfer their shares to the securities system of Euroclear Sweden AB before the record date of the Rights issue.

In addition, to be able to trade on Nitro Games’ shares on First North, investors who have their shares in a book-entry account in Finland will need to transfer their shares to the securities system of Euroclear Sweden AB.

Such cross-border settlement may be associated with additional costs pursuant to the settlement parties’ respective fee schedules.

Prospectus

The terms and conditions of the Rights issue will be included in the Company’s EU growth prospectus, which is expected to be published on 5 July 2023. The prospectus and subscription form will be available on the Company’s website, https://www.nitrogames.com/investors/, on Augment Partners AB’s website, www.augment.se/offerings/, and on Aqurat Fondkommission AB’s website, aqurat.se/aktuella-erbjudanden/.

Advisers

Augment Partners AB is acting as the financial advisor and Smartius Ltd is acting as the legal advisor in the transaction.

For more information:

Jussi Tähtinen,

CEO & Co-Founder

Phone: +358 44 388 1071

Email: jussi@nitrogames.com

This company announcement contains information that Nitro Games Oyj is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication by the aforementioned contact person on 13 June 2023 at 09:30 (Finnish time).

IMPORTANT INFORMATION

Publication or distribution of this press release may in some jurisdictions be subject to statutory and legal restrictions and persons in those jurisdictions where this press release has been published or distributed should inform themselves about and observe such restrictions. The information in this press release does not constitute an offer to acquire, subscribe or otherwise trade in shares or other securities in Nitro Games.

This press release does not constitute an offer to acquire securities in the United States. The securities mentioned herein may not be sold in the United States without registration in accordance with The Securities Act of 1933 or without the application of an exception to such registration. The information in this press release may not be released, published, reproduced or distributed in or to the United States, Australia, Canada, New Zealand, Hong Kong, Japan, Switzerland, Singapore, South Africa, or any other country or jurisdiction where such action is not permitted or such action is subject to legal restrictions or would require further registration or other measures than required by Swedish law. Measures contrary to this instruction may constitute a breach of applicable securities laws.

Nitro Games in brief:

Nitro Games is a mobile game developer and publisher. Nitro Games team is a multinational group of mobile gaming professionals with expertise from development to publishing to live operations. The Company focuses on producing high-quality mobile games mostly for the mid-core audience. Nitro Games is specialized in the category of shooter games. With Nitro Games’ powerful NG Platform and the NG MVP process, the Company is able to carry out market validation with its games during development. Nitro Games has developed several games such as Autogun Heroes, NERF: Superblast, Lootland, Heroes of Warland, Medals of War, Raids of Glory. The company offers its services also to selected customers and has developed several successful projects to leading mobile gaming companies.

Nitro games’ shares are listed on Nasdaq First North Growth Market with the ticker NITRO. The Certified Adviser is FNCA Sweden AB, info@fnca.se.

www.nitrogames.com

Finnish Business ID: FI21348196